Compliance and auditing often create a sense of dread, involving tedious tasks such as gathering receipts, filling out complex forms, and minimizing human error. Thankfully, mileage tracker apps have transformed these tasks, making them as simple as using your smartphone. These apps are not just advanced logbooks; they are robust tools designed to facilitate compliance and auditing, allowing you to focus on your core activities while ensuring your records are accurately maintained.

In this detailed guide, we will explore the myriad benefits of mileage tracker apps and how they streamline mileage management effectively and efficiently.

Benefits of Mileage Tracker Apps

1. No More Headaches with Manual Documentation

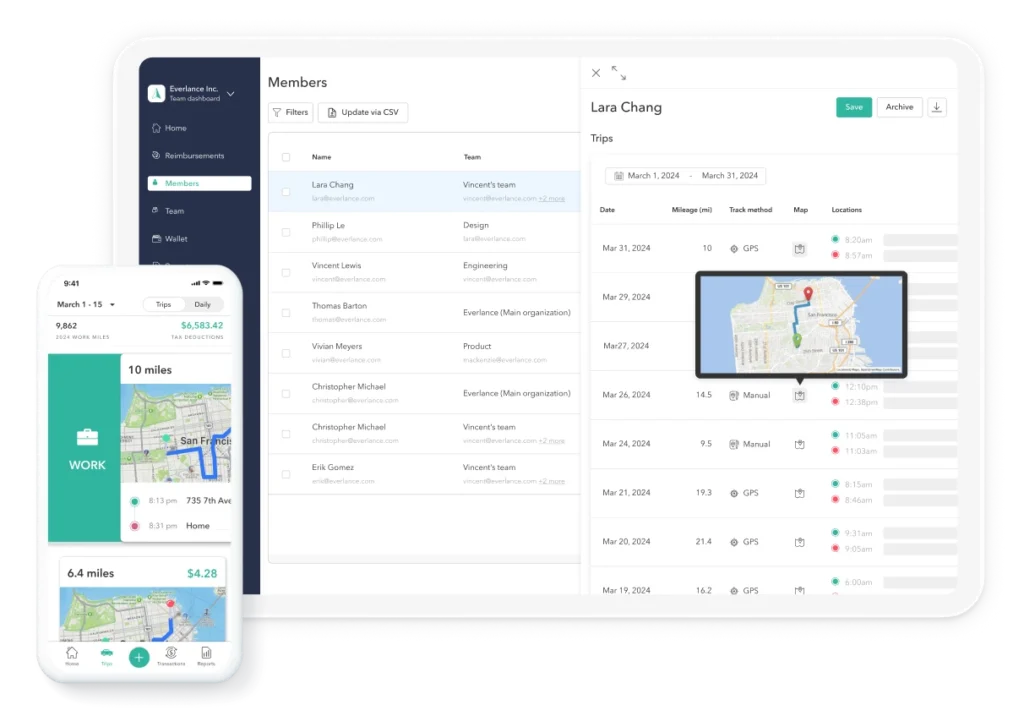

Traditionally, logging mileage required pen and paper, leading to errors and incomplete records. Mileage tracker apps have revolutionized this process. Automatic logging within these apps ensures every mile driven is captured without manual input. This results in a seamless, continuous record of both professional and personal trips.

Case Study: Real-World Impact

A freelance consultant who previously logged each trip manually often missed entries or made errors. With a mileage tracker app, all trips are automatically recorded, providing an accurate log for tax deductions or expense reporting.

2. Convert Your Tool to a Financial Asset

Mileage tracker apps are more than just convenient logbooks; they are valuable financial assets. For self-employed individuals and business owners, tracked miles can translate into significant tax deductions. Employees traveling for work can easily claim reimbursement for their travel expenses. These apps ensure you capture the full financial value of each mile, with accurate calculations and without the hassle of sifting through paper records.

Example: Maximizing Tax Deductions

A small business owner using a mileage tracker app captures all business miles, ensuring maximum tax deductions. The app’s automatic tracking and categorization help in claiming all eligible deductions without the risk of overpayment.

3. Automate to Save Time

Time is a precious resource, and mileage tracker apps are designed to save it. By automating mileage logging and categorization, these apps eliminate manual data entry. This automation frees up valuable time for more strategic business activities.

Practical Time Savings

An employee who previously spent hours each month preparing mileage data can now automate this process with a mileage tracker app, allowing them to focus on their core responsibilities.

4. Reduce Human Error

Human memory is fallible, and manual mileage logging is prone to errors. Mileage tracker apps use advanced technology to track and calculate each drive with high precision. This level of accuracy minimizes errors in mileage reporting, reducing discrepancies in tax or reimbursement submissions.

Audit Accuracy

During an audit, accurate mileage records are crucial. Mileage tracker apps provide precise, real-time data, reducing discrepancies and ensuring compliance with tax requirements, making audits less stressful.

5. Gain Insights into Driving Patterns

Modern mileage tracker apps do more than track; they provide insights into driving patterns. These insights can be used to optimize routes, improve fuel efficiency, and reduce overall travel costs. Analyzing driving habits enables better-informed decisions for time and cost savings.

Smarter Fleet Management

For businesses with a fleet of vehicles, mileage tracker apps help monitor usage patterns, fuel consumption, and inefficiencies. This data-driven approach allows for route optimization and improved fleet performance.

6. Encourage Green Choices

Mileage tracker apps contribute to sustainability by helping drivers understand their driving patterns and distances. This awareness often leads to greener choices, such as consolidating trips, optimizing routes, or exploring alternative transportation methods.

Sustainability in Action

A business using mileage tracker apps may find opportunities to reduce travel by consolidating meetings or adopting teleconferencing, leading to lower emissions and a more sustainable approach to business travel.

7. Data Security and Privacy

In a digital world, protecting mileage records is crucial. High-quality mileage tracker apps offer robust encryption and strict access controls to ensure data security. Regular backups further reduce the risk of data loss, keeping your records secure and private.

Protecting Sensitive Information

For businesses handling sensitive financial data, mileage tracker apps with advanced security features ensure that records remain secure from unauthorized access and potential breaches.

8. Simplify Compliance and Auditing

Mileage tracker apps simplify compliance and auditing by adhering to tax guidelines and generating real-time reports. This reduces the risk of non-compliance and makes the audit process less stressful. Accurate record-keeping is essential for tax purposes, and these apps ensure your logs are updated with current tax rates and mileage deductions.

Preparedness for Audit

During tax season, having accurate and updated mileage logs is essential. Mileage tracker apps generate detailed reports that are ready for presentation, ensuring compliance with tax regulations and reducing stress during audits.

9. Classify Trips with Accuracy

A key feature of mileage tracker apps is the ability to categorize trips as personal or business-related. This classification is crucial during an audit, as it provides clear and precise documentation. An electronic log that is easy to navigate simplifies record-keeping and makes it easier for auditors to review your records.

Trip Categorization

Businesses with various types of travel, such as client meetings and personal errands, benefit from accurate trip categorization. Mileage tracker apps allow for detailed and systematic categorization, ensuring thorough and organized records.

10. Optimize Fleet Management

Mileage tracker apps provide valuable resources for businesses operating a fleet of vehicles. They track vehicle usage, monitor fuel efficiency, and identify areas for improvement. Enhanced visibility into fleet performance helps businesses make data-driven decisions to improve efficiency and reduce costs.

Fleet Performance Insight

A company managing a delivery fleet can use mileage tracker apps to monitor performance, track fuel consumption, and optimize routes. This insight leads to better fleet management and cost savings.

11. Enhance Tax Reporting

Mileage tracker apps generate highly detailed reports that are invaluable for tax reporting. These reports include comprehensive breakdowns of mileage, expenses, and categories, making tax preparation easier and ensuring compliance with tax legislation.

Tax Preparation Made Easy

With detailed mileage reports readily available, tax preparation becomes significantly easier. Mileage tracker apps provide clear documentation of business-related travel, simplifying the process of compiling data for tax reporting and ensuring all eligible deductions are claimed.

12. Ease Expense Reimbursement

Mileage tracker apps simplify the expense reimbursement process for employees traveling on business. Detailed logs and reports facilitate accurate expense claims, reducing administrative tasks and ensuring timely reimbursement.

Smoothen Reimbursement

Employees who frequently travel for business can use mileage tracker apps to generate thorough expense reports, which can be submitted for reimbursement. This ensures claims are accurate and processed efficiently.

Conclusion

Mileage tracker apps offer far more than just tracking miles; they streamline compliance and auditing, making these processes faster, more accurate, and less stressful. By automating documentation, minimizing human errors, and providing valuable insights, these apps help businesses and individuals navigate regulatory requirements efficiently. As technology advances, mileage tracker apps are set to become invaluable tools for professionals and businesses aiming to remain competitive and manage operations effectively in a digitized world.